Invoices in Singapore: All You Need to Know

- What is an Invoice?

- Singapore Invoice Example

- What Should Be Included in an Invoice

- Types of Invoices in Singapore

- Invoicing Tools for Singapore

What is an Invoice?

An invoice is an official document in Singapore that an Singapore company sends to its customer when it sells products or offers services. The invoice indicates exactly what product has been sold, or what service has been offered and for how much. It can be seen as a request for payment and includes payment details so that the customer can pay the company. A good invoice needs to be precise and free from any unnecessary additions.

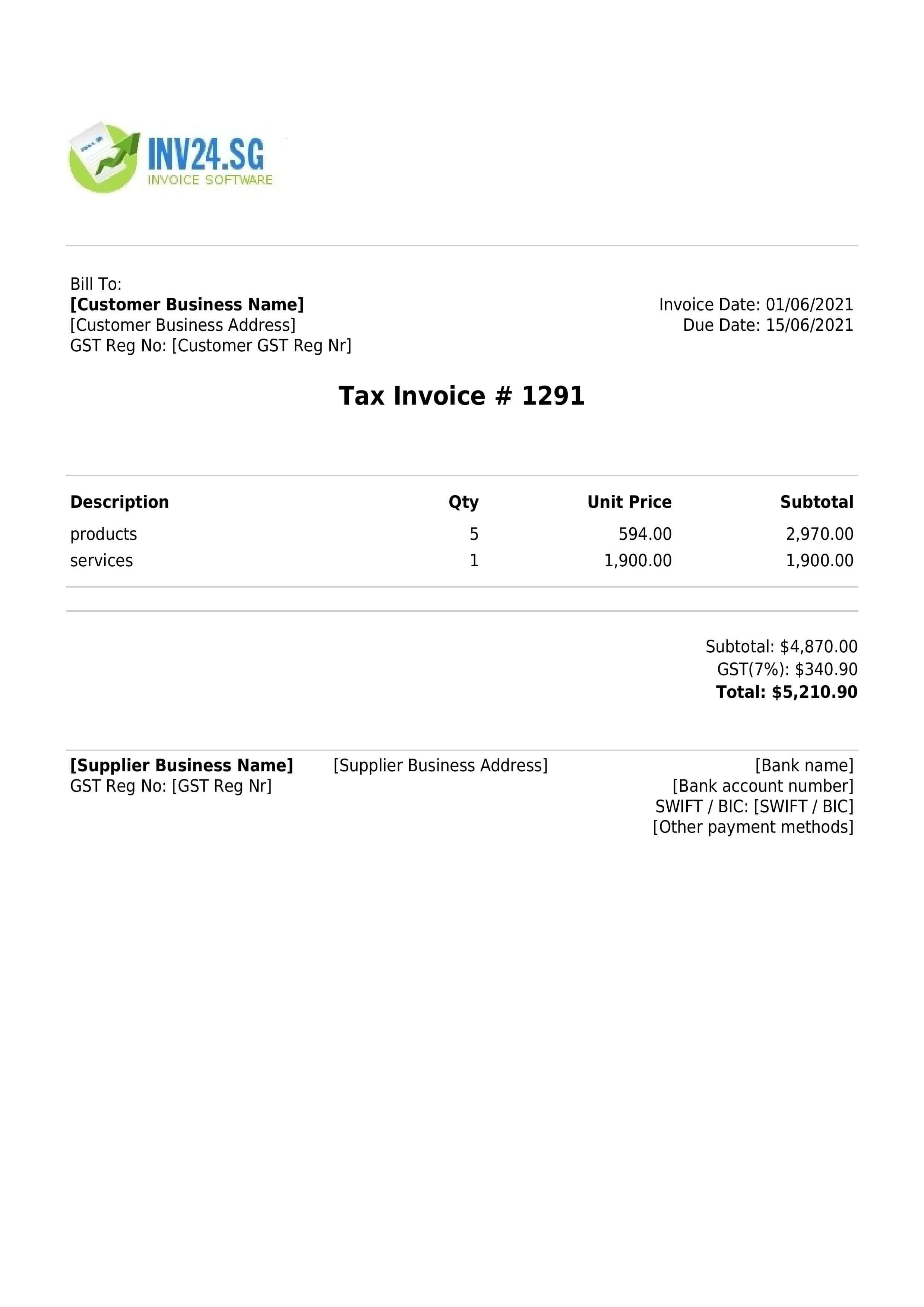

Singapore Invoice Example

What Should Be Included in an Invoice

There are the requirements for a standard, well-formed invoice in Singapore:

Invoice Details

These are the details/sections a proper invoice should have:

- Invoice title: Invoice title should clearly state that it is an invoice as it allows the client to instantly see what they are receiving and how they can handle it.

- Invoice number: It helps in tracking the invoice as well as keeping your financial records in order.

- Invoice date: The date that the invoice was created and sent.

- Description of products or services provided: The description should be explicitly stated and clearly written. It should also be as brief as possible. There is no need for long drawn out service/product detailing.

- Details of quantities of products: Fill out the correct quantity of all products supplied.

- Unit prices: Specify the amounts clearly. To minimise the risk of differences due to rounding, it is recommended that the prices should be rounded to two decimals for accounting purposes.

- Details of any discounts given: Specify the precise discount given and which products or services had been discounted.

- Subtotal / Net price: The total amount of all services or goods offered minus GST. This is also the amount you apply the GST rates to.

- The GST rate/rates applied: GST varies from product to product. Ensure that you're up to date with the current GST rates.

- The total amount of GST charged: Calculate the total value of the GST rates and specify it clearly.

- The total / Gross amount of the invoice: The sum total of all the products or services offered plus GST rates. This is the definitive amount the client will pay. Make sure that it is correct in order to avoid any delayed payments.

- Company name: Your business name.

- Company business address: Your business address.

- GST Reg No: This is necessary for taxation purposes. The requirement is omitted if your company does not have GST registration number and does not pay GST.

- Client’s company name: Your client's business name.

- Client’s company address: Your client's business address (billing / shipping address).

- Client’s GST Reg No: For taxation purposes, your client’s GST number must be on the invoice. The requirement is omitted if the company does not have GST registration number.

- Currency: A necessary addition to the invoice to ensure no financially related confusion ensues.

Optional Invoice Details

These sections/details can be added or left out depending on your preference:

- Logo: The business logo on an invoice.

- Due date: The date the total payment is due.

- Late fee: A late fee is charged to the customer when they fail to pay an invoice or make payment by the agreed date.

- Payment details: Your company’s bank details or any other payment option you prefer. For example, Bank name, IBAN, SWIFT/BIC or PayPal or cash.

- Email address: Your official business email address.

- Phone number: The official phone number of your business.

- Payment reference number: Helps to track payments.

- Customer number: The numbers that are assigned to track business activities with your customers.

- Notes: An extra information for the customer provided by seller.

- Footer message: A short message for the customer at the very bottom section of the invoice.

- Disclaimer: A legal message that is written and included in the invoice.

- Order number: A unique number assigned to each order when it is placed.

- Delivery date: The date when products were delivered (or services were performed) to the customer.

- Seller’s contact: The contact details of the seller.

- Customer’s contact: The contact details of the person to whom the seller is to contact.

Primary Sections of the Invoice

- Invoice Header: located at the top section of the invoice

- Invoice Body: situated at the central part of the invoice

- Invoice Footer: refers to the lowest section of the invoice

Types of Invoices in Singapore

- GST Invoice: standard invoice issued by a GST payer

- Invoice for GST non-payer: standard invoice issued by a GST non-payer company

- Proforma invoice: simple request for payment

- Credit note: refunding a customer

- Recurring invoice: automatic invoicing a subscribing customer

- Debit note: requesting a refund from a vendor

- Sales invoice: outgoing invoice to a customer

- Purchase invoice: incoming invoice from a vendor

- Supplier invoice: supplier sends a formal payment request to the customer

- Vendor invoice: generated by the vendor

- Self-billing invoice: the buyer prepares and sends an invoice to the seller

- Advance invoice: customer is required to pay before goods are delivered or services performed

- Progress invoice: for the completed percentage of the work on the project

- Prepayment invoice: request a prepayment from the customer

- Partial payment invoice: a partial payment for a specific products or services

- Deposit invoice: request a deposit from the customer

- Retainer invoice: payment request for a retainer fee

- Interim invoice: request for payment for work completed that is sent to the customer before the completion of the large project

- Final invoice: the project has been completed or the goods and services have been supplied to the customer

- Service invoice: a customer is requested to make payment for services which have been performed for them

- Product invoice: the business requests payment for the products or goods that have been dispatched or delivered to the customer

- Paper invoice: printed invoices

- Paperless invoice: created and sent in electronic format without printing on paper

- Incorrect invoice: an invoice with an error

- Disputed invoice: a customer raises concerns about the accuracy of the invoice

- Rejected Invoice: the customer does not accept the invoice sent by the supplier or seller

- Duplicate invoice: two invoices are generated for a single delivery

- Overpaid invoice: the customer has paid an excess amount

- Underpaid invoice: the customer does not make full payment

- Overdue invoice: customer fails to make payment by the due date

- Void invoice: makes an impact of zero on the accounting record

- PEPPOL invoice: an electronic invoice via the PEPPOL network

- EDI invoice: an electronic invoice in an EDI standardized format

- cXML invoice: electronic invoicing in cXML format

- Branded invoice: reflects branding elements: logo, theme, design, fonts, colors

- Invoice with a discount: contains a discount, which reduces the amount payable

- Invoice with bank details: payment request through a bank transfer

- Crypto invoice: the payment is requested in cryptocurrencies

- Paid invoice: an invoice that has already been paid by the customer

- Timesheet invoice: summarizes the hours worked on a specific project

- Freight invoice: an invoice for the transportation of the goods

- Batch invoice: multiple invoices are processed together in a single batch

- Consolidated invoice: two or more invoices are combined

- Intercompany invoice: sales transactions between two units or subsidiaries or divisions of the same parent company

- Balance payment invoice: it serves as a reminder to pay the remaining balance

- Original Invoice: the first version of the invoice that has not been modified or edited

- Invoice Copy: an identical version of the invoice is created

Business Documents That Are Used Together With Invoices

- Receipt: a proof that the customer has paid for the goods or service

- Price quote: price offer of a fixed price for specific goods or services

- Job estimate: a document that lists a projected cost for completing a job for the buyer

- Statement of accounts: a financial document that summarizes all the transactions between the seller and customer

Invoicing Tools for Singapore

- Simple Invoice Software for Singapore

- 102 Free Invoice Templates for Singapore - Word, Excel, PDF, Google Docs/Sheets

- PDF Invoice Generator for Singapore [Free]

Additional Invoicing Tips

Whenever you send an invoice notification email to a customer, it is advisable to add a simple, “thank you” at the end. This shows politeness and professional friendliness. Just these two simple words makes an impression that you care about your client and that you would like to have a continuous and long term business relationship with them, which will definitely help with the growth of your business.

Ensure that every detail on the invoice is correct before you send it to your customer. This will prevent any hassle on your customer’s part, as they would not want to waste time having to contact your company and requesting any changes to your invoices. It is not seen as very professional if you have any mistakes on your invoices and could even lead to frayed relationships with your clients which could impact and hinder your business. In addition, having the wrong information on an invoice may lead to delayed payments for your goods or services.

Frequently Asked Questions

What does invoiced mean?

The term invoiced, refers to the process of generating and sending a formal payment request to a certain customer. This request will include content such as, invoice amount, date, description, payment terms, to name a few. Furthermore, the term "invoiced" could also be used to describe an order status in the CRM or ERP sales circle.

What is an invoice payment?

The invoice payment is the amount paid or received against a specific invoice under consideration. As soon as payment is received, the corresponding invoice is marked as paid, in the accounting system. The paid invoice is also known as a closed invoice.

What are invoices used for?

There can be various ways that an invoice can be used. Some of the following are outlined below:

Payment request

In this situation, an invoice serves as a formal request for payment. It is a payment request that the seller generates and sends to the buyer.

Documentation

An invoice is a legal document which enlists trade components between parties. Therefore, any dispute between parties in the trade can be resolved by the use of an invoice. Another documentation use, is that the invoice is equally important for operational and regulatory functions (audit & tax).

Financial reporting

An invoice also serves as a source document for updating the accounting system. This document is important for requesting payment, building accounting records as well as for reporting financial performance.

What is an invoice ID?

An invoice ID is a unique number or a combination of numbers and letters which are assigned to each invoice. This ID is used for identifying and tracking the invoices. Having ID numbers to keep track of payments is vitally important, as it helps to resolve any disputes between the parties in the trade.

What is invoice billing?

Invoice billing refers to the process of sending invoices or bills to the customer. The process involves the following:

- Verifying the goods dispatched

- Sending the invoice

- Tracking the payment

- Keeping records

- Closing the invoice once payment has been received

Can invoices be used as receipts?

The answer is “Yes”, invoices can be used as receipts for cash sales. When using the invoices as receipts, marking them as paid can be seen as ideal. This will limit any confusion in terms of payment collection. Despite this, it is not an encouraged practice to use the invoice as a receipt since both documents have distinct purposes. For instance, the invoice is used as a payment request, and the receipt confirms the payment received.

Why are invoices important?

Invoices are considered essential business documents. The reasons for this is as follows:

Payment facilitation

The invoice serves to facilitate the flow of payment from the customer to the supplier. In this way, the invoice is a source that provides the legal basis for collecting the payment from customers.

Keeping the records

As the accounting record is essential for tax and audit purposes, the invoice acts as a source document and an essential component of accounting records.

Tax compliance

An invoice can also be an important document for taxation purposes. Output GST is calculated using the sales invoice value for the seller. On the other hand, input GST (on purchase) is calculated using the same invoice, except from the customer's perspective. Similarly, income tax is calculated based on the revenue from sales invoices.

Financial reporting

Profit and loss can be calculated and the execution of the overall financial reporting can proceed using the invoices. This is because the amount of revenue is compiled using invoices.

Cash flow forecasting

The invoice's due date helps to indicate when invoices are to be collected. This therefore, helps to plan and achieve financial management goals.

Do invoices need to be signed?

The sign requirement on the invoice will vary from business to business, depending on the company policy. It will also depend on the applicable jurisdiction. Basically, there is no general rule which dictates whether sales tax invoices are required to be signed. However, the invoice may require a signature, if specific terms lead to a contract between the parties in the trade.

Distinctly, commercial invoices (used for import/export) must be signed.

Does an invoice mean that you have paid?

No, having an invoice does not signify that you have paid. Instead an invoice means you have a payment request for the goods and or services that you have received from the vendor. Hence, it does not indicate that payment has been made. However, if the invoice is marked as “paid”, in this situation it means you have paid that specific invoice.

Are invoices legally binding documents?

Yes, invoices are considered as a legally binding document and each component of the invoice is legally enforceable. In this regard, it is important to note that the content of the invoice must be backed by relevant source documents. For instance, the product quantity should align with the delivery note and purchase order. Similarly, the product rate should be the same as what is detailed in the quote or price list.

When should invoices be sent out to a customer?

The invoice should be sent to the customer as soon as the goods are delivered or services are rendered. By sending the invoice, it means that you have communicated your right to receive the funds against the goods delivered or for the services rendered. As soon as you have fulfilled your obligation as a seller, of dispatching the goods or providing the services, then the invoice should be sent to the customer.

What is SaaS billing?

SaaS billing stands for billing software as a service. It is a cloud-based billing software that provides billing services via a web browser. The use of this kind of software is based as a subscription business model. By paying for a monthly or yearly subscription fee, the users are able to access software services for the period under consideration.

What is an invoice on a package?

An invoice on a package means that the invoice is physically placed inside the package or shipment which has been delivered to the customer. This practice is common in international trade where goods are imported and exported. This invoice enlists essential components which include seller and buyer information, invoice number, goods description, total amount, payment terms, and shipping information as well as others.

The information and content on the invoice enables customs officials to assess the goods' value, apply taxes/duties, and it also serves as proof of trade between parties.

What to say when sending an invoice?

It is a good idea to have a professional introduction when sending the invoice. For example, “This is a payment request against (specify goods/services delivered to the customers)". It is also common practice to communicate the due date and applicable payment terms.

Similarly, headers, titles and subjects should clearly state that this is an invoice.

Here is a sample email template which can be used when sending the invoice.

Dear Sir/Madam,

I hope you are doing great!

Please see the attached invoice (invoice number) for the (products delivered/services performed) dated (Date). The total for the invoice amounts to (total amount to pay), and the due date is (Date).

Kindly remit the payment using following details.

Your account title: (XXXX)

Your account number: (XXXX)

Your bank name: (XXXX)

Your bank BIC: (XXXX)

Further, if you have any questions or suggestions about the attached invoice, kindly reach out as soon as possible.

Thank you!

(Your name)

(Your post in the company)

(Your company name)

What is an invoice, in simple words?

An invoice means that you as a customer, have purchased the goods or services from a particular seller. The seller uses the invoice to request payment for their delivery. Just by perusing the invoice, you can be notified how much is payable, the last date to settle the payment (due date), applicable tax(es), the total amount, and applicable payment terms.

What is an invoice in business studies?

In business studies, the invoice is a document that the seller generates, in order to receive payment from the customer. The invoice reflects the fact that the seller has dispatched specific goods to the customer and is now asking for the payment.

What is an invoice in online shopping?

The concept of an invoice in online shopping is the same as in conventional shopping. The layout and content of the online invoice are the same as a conventional invoice. An online invoice, similar to a conventional invoice, acts as proof of the transaction and can be used in the case of returns or warranty claims.

Who makes invoices in a company?

Generally, the sales or accounting department generates invoices for the customers. In the case of large businesses, companies implement a sales system which is linked to the accounting system. This is highly efficient, as once the invoice is generated using the sales system, the integrated accounting system is automatically updated.

Further, small business owners can issue invoices themselves.

What is automated invoicing?

Automated invoicing means the invoice was generated using software that automates the process. In other words, the invoice preparation steps were completed automatically, without human intervention. For instance, invoicing software is integrated with the dispatch system. In this example, when generating the invoice, the invoicing software fetches the quantity and description from the dispatch, to use in the bill or invoice. So, the invoice is prepared without human involvement, leading to lower chances of error.

What is an invoice received?

The term invoice received, means the bill was received for purchasing the goods or services. In other words, the business must now make payment for the purchases, as the invoice was received.

Are the invoices accounts receivable?

The answer to this is “yes”, the sales invoices are accounts receivable. If you are a seller generating the invoice, then the posting of this invoice in the accounting system leads to the creation of accounts receivable.

Are invoices, accounts payable?

If you are a buyer receiving an invoice from the seller, then the posting of this invoice in the accounting system will create accounts payable. So, “yes”, purchase invoices are accounts payable.

What is invoice tracking?

Invoice tracking refers to the practice of keeping an eye on the real-time status of the invoice. For instance, the status of a particular invoice may be, under processing or pending, reviewed or approved, generated, sent, payment received, closed or revised.

Tracking the invoice status is an essential way of generating a budgeted cash flow statement which helps to assess the liquidity status of the business.

What is the best way to send an invoice?

Generally, any invoicing method that involves minimum human intervention is considered to enhance the excellence of the billing process. In this regard, sending an automatic invoice via software, is considered as an effective and fast way of billing. Further, to enhance the quality of the invoicing and billing process, it is recommended that all the applicable controls be strengthened and validated.

What is the best way to create an invoice?

The best way to create an invoice is via automation. This automation will lead to a seamless flow of data across the generating process. It is an automatic way of generating an invoice. So, since there is little human intervention in this process, there will be lower chances of error.

What is a manual invoice?

As the name suggests, a manual invoice means that the invoice was prepared with significant human intervention. All the content and information in this invoice has been inputted and copied by humans that are relying on the source documents. For instance, the quantity in the invoice has been written in the invoice by manually looking at the delivery note. As expected, this manual intervention leads to a considerably higher chance of error. Despite this, the upside is that the cost of manually generating the invoice is minimal.

What is an invoice order?

The term invoice order, can be used in different contexts. Some examples of this follows:

Invoice generating instructions

You may receive orders or instructions requesting an invoice to be generated, against a recent shipment. This will be called a document invoice order.

Sales order

The document generated by the seller to confirm the content of a particular order, can also be called an invoice order.

Purchase order

The document prepared by the buyer to place an order with the seller, can also be called an invoice order.

So, the meaning of invoice order needs to be extracted, depending on the context.

Are invoices contracts?

The answer to this question is “no”, invoices are payment requests only and are not contracts.

To highlight the distinction, the purpose of a contract is to agree on the terms and conditions of the trade. With the signing of the contract by both parties, each party hereby agrees to the given terms and conditions to initiate the trade.

On the other hand, sending the invoice are only requests for payment, for the goods delivered or services rendered.

Who uses invoices?

The usage of invoices can be made by both seller and buyer and it is an equally useful document for both parties. The seller uses invoices in order to post sales in the accounting system as well as to collect payments. On the other hand, the buyer uses invoices to post purchase or expense details in the accounting system and for payment processing purposes.

What comes before an invoice?

Before invoice generation, a series of documents will be generated. The sequence includes the following.

Generating the quote (or estimate)

The seller generates the quote in line with the customer requests. The quote is considered an offer in the trade.

Formation of purchase order

The purchase order is generated by the buyer and sent to the supplier. When the seller accepts this purchase order, it is considered as contract formation.

Sending the sales order

The seller sends the sales order back to the customer to confirm the details and content of their order. Such information could include quantity, rate, quality and scale, as well as other details.

Delivery note

The delivery note is signed by the staff that have physically received the goods. This note acts as a basis for confirming the dispatch and the generation of invoices from the seller's perspective.

What do you do with an invoice?

There are different uses of an invoice, depending on whether you are the buyer or seller. For buyers, the invoice is used to record purchases as well as to keep the records for audit and tax purposes.

On the other hand, the invoice is used by the seller to record sales or revenue. The sales invoice posts revenue in the accounting system and helps to compile the profit and loss statements. It is also equally important for tax and audit purposes.

What does an invoice indicate?

The receipt of an invoice from a vendor, indicates that they are requesting payment for the goods delivered or services which have been performed by them. On the other hand, sending the invoice from the vendor to the customer, means that the business has realized the sales and are now making a request to collect the payment.

What do I need in order to invoice someone?

You will need to invoice a customer if you have dispatched the goods or performed services for them. The invoice is considered a legal tool in order to get compensated for the obligation which you have fulfilled. This obligation may be in the form of delivering the product or rendering the service.

What is raising an invoice?

Raising the invoice simply means creating or preparing, in addition to sending the invoice. The invoice is prepared at the time when the goods are delivered or the services have been performed for the customer.

Can I refuse to pay an invoice?

Yes, you are able to refuse to pay an invoice, and this is generally done in the event of a dispute. The dispute can be in regards to any trade area, such as, faulty goods received, wrong invoice amount, incorrect tax(es) applied, low-quality goods received and so on.

Can I refuse to pay old invoices?

You are unable to refuse to pay old invoices, without a valid justification. In an attempt to resolve any issue you have with a vendor that issued the invoice, you can reach out to the vendor. This will be done so that you can try to negotiate to see if there is a way to obtain some discount on the old invoices.

Can I refuse to pay a late invoice?

In the event that you wish to refuse to pay an invoice, this must be backed by some solid justification. In this situation, it is ideal to contact the vendor to negotiate the balance. If you simply refuse to pay the invoice without any basis, this may lead to potential legal repercussions.

Can you legally charge interest on overdue invoices?

The answer is “yes.” You are able to charge interest on overdue invoices. However, there are a few considerations which you need to bear in mind. For instance, depending on the applicable jurisdiction, there may be the imposition of certain limits in the form of applicable rates, interest days, and contractual provisions between parties in the trade.

Can you send an invoice before the work is done?

You are able to send the payment request (or invoice) before work is done. However, in line with accounting standards, you are unable to record the revenue on the basis of such invoice. However, the liability as an obligation, has to be settled as of now.

In other words, by sending the invoice and collecting payment in advance, you have received cash, via liability. Once the related work is done, it should be converted to revenue.

Can you write off unpaid invoices?

The answer is “yes”, unpaid invoices can be written off. In doing so, ensuring compliance with company policy, accounting standards, and taxation policies is important. Generally, invoices are written off when the business believes that it cannot collect the payment against specific invoices from a customer. Further, if the business faces write-off problems, routinely, they can create general provisions for the bad debt in order to measure prudent business performance.